Leading with AI: Strategic Decision Making in the Age of Human-Analogue Machines

The Atomic Human Perspective for Banking Transformation

Neil D. Lawrence

Leading with AI Programme, Cambridge Judge Business School

Introduction: The Age of Human-Analogue Machines

Henry Ford’s Faster Horse

The Atomic Human

Understanding Human vs Machine Intelligence

O M D P C F B V

H G J Q Z Y X K W

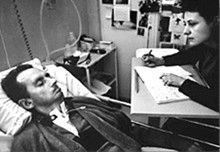

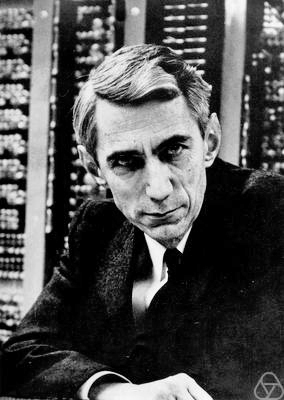

Bauby and Shannon

|

|

|

|

|

|

|

|

bits/min

|

billions

|

2000

|

6

|

|

billion

calculations/s |

~100

|

a billion

|

a billion

|

|

embodiment

|

20 minutes

|

5 billion years

|

15 trillion years

|

The Information Revolution in Banking

New Flow of Information

Evolved Relationship

Evolved Relationship

The Evolution of Decision Making in Banking

Networked Interactions

Bezos memo to Amazon in 2002

The API Mandate

- All teams will henceforth expose their data and functionality through service interfaces.

- Teams must communicate with each other through these interfaces.

- There will be no other form of inter-process communication allowed: no direct linking, no direct reads of another team’s data store, no shared-memory model, no back-doors whatsoever. The only communication allowed is via service interface calls over the network.

- It doesn’t matter what technology they use.

- All service interfaces, without exception, must be designed from the ground up to be externalizable. That is to say, the team must plan and design to be able to expose the interface to developers in the outside world. No exceptions.

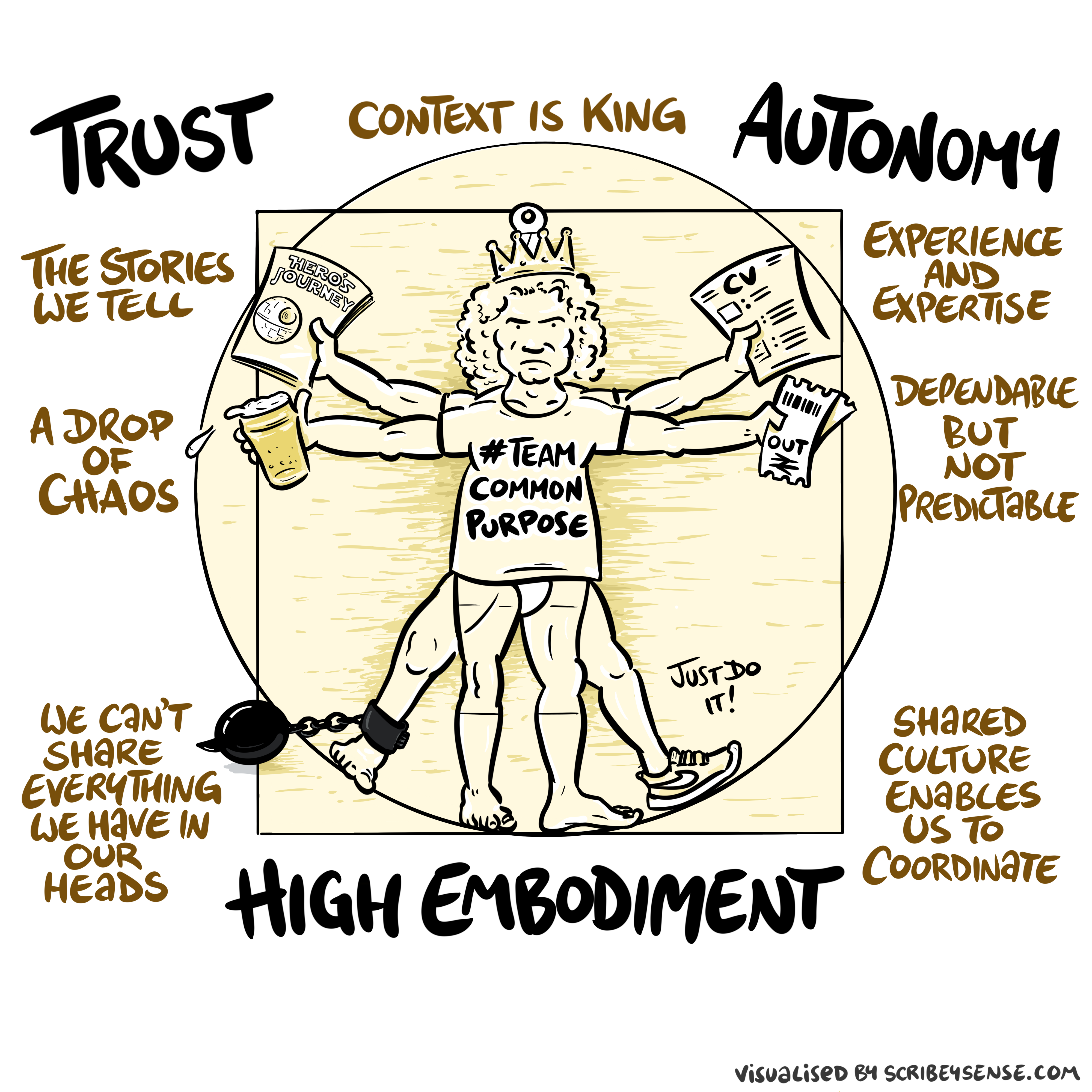

Duality of Corporation and Information

- What is less written about is corporate structure.

- This information infrastructure is reflected in the corporation.

- Two pizza teams with devolved autonomy.

- Bound together through corporate culture.

Conway’s Law

Any organization that designs a system (defined broadly) will produce a design whose structure is a copy of the organization’s communication structure.

Conway (n.d.)

Information Topography: How AI Reshapes Banking Decision Making

An Attention Economy

- Human attention will always be a “scarce resource” (See Simon, 1971)

- Humans will never stop being interested in other humans.

- Organisations will keep trying to “capture” the attention economy.

Balancing Centralized Control with Devolved Authority

Question Mark Emails

Executive Sponsorship

- Direct sponsorship from the most senior executive.

- This has a cultural effect as well as a direct effect.

- Bring about through involvement

- develops understanding of capabilities of data science in exec team.

Pathfinder Projects

- In executive context: an important project that is interdepartmental.

- Should involve the CEO, CFO, CIO and data science team (or equivalents).

The Horizon Scandal

|

|

|

|

Complexity in Action

Techno-Inattention Bias in Banking

- Banking organizations develop “techno-inattention bias” - focusing on AI details while missing human dynamics

- The “gorilla” of customer relationships, regulatory compliance, and ethical considerations goes unnoticed

- Institutional inattentional blindness develops when leadership fixates on technical aspects

The Danger for Banking

- AI fascination distracts from nurturing irreplaceable human elements

- Customer trust and relationship management become secondary to technical efficiency

- Regulatory and ethical considerations get overlooked in the rush to automate

Human Attention as the Scarce Resource in Banking

The Attention Economy

Herbert Simon on Information

What information consumes is rather obvious: it consumes the attention of its recipients. Hence a wealth of information creates a poverty of attention …

Simon (1971)

Emulsion: Combining Human and Machine Intelligence in Banking

Attention Reinvestment Cycle

Generative AI as Human-Analogue Machines (HAMs)

Generative AI as HAM

- Generative AI provides us with an “analogue human”

- An information amplifier with a multiplier of 300,000,000.

- Radically changes information infrastructure

- From Conway’s Law: All existing models redundant.

Human-Analogue Machines (HAMs) as Banking Tools

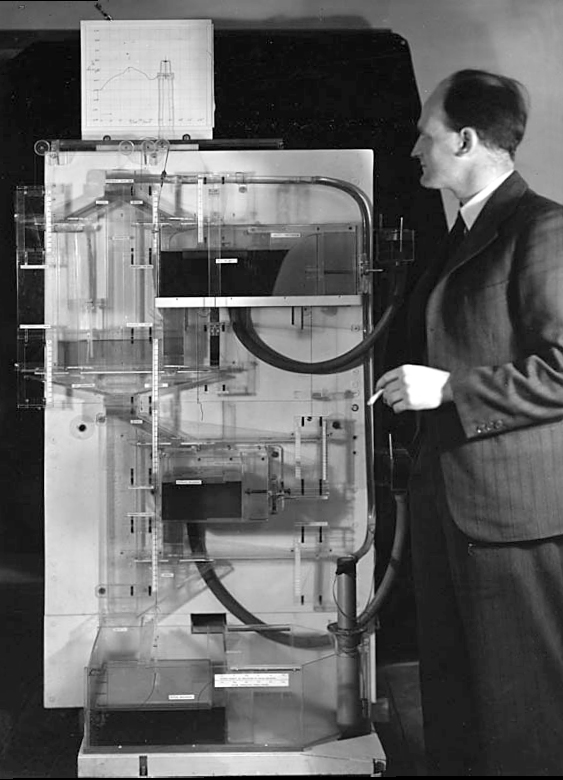

The MONIAC

Human Analogue Machine

HAM

The Banking Challenge

- We know everything we’re doing now is wrong.

- We don’t know how it’s wrong.

- “Marconi approach” unlikely to work

The Uncertainty Principle of Human Capital Quantification

Inflation of Human Capital

- Strength in Human Capital double-edged sword.

- Automation creates efficiency.

- But skills risk becoming redundant.

The Business Imperative: People First, Not AI First

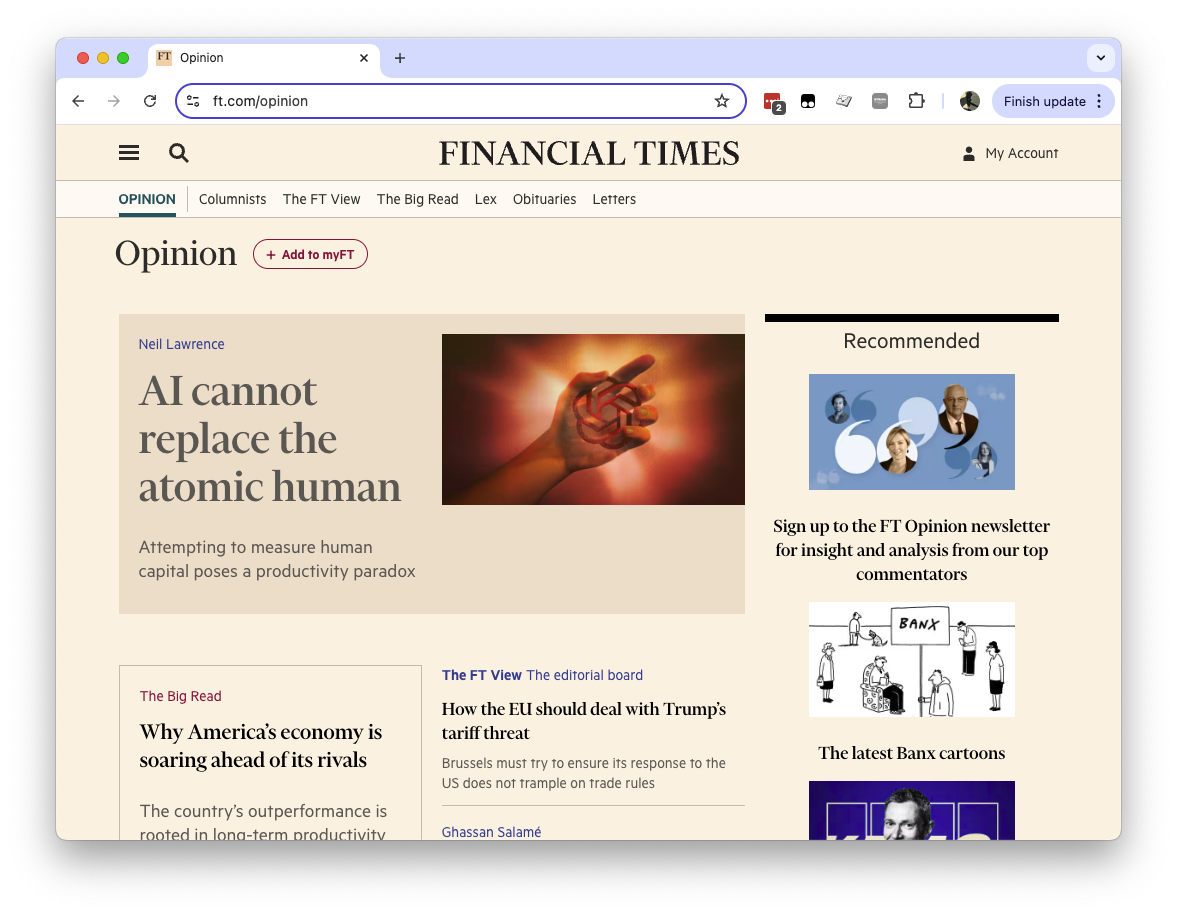

AI cannot replace atomic human

Atomic Human Approach for Banking

- Human attention the differentiator.

- Focus on how your human capital needs to adapt.

- People first approach, not AI first.

Superficial Automation

- AI enables automation of surface-level tasks

- Examples: Email writing, document summarization

- Risk of losing deeper value in the process

Hidden Value

- Email writing builds relationships

- Documentation creates institutional memory

- Human pauses enable reflection

The Automation Challenge

- Complex ≠ Complicated

- Speed isn’t always progress

- Augment humans, don’t replace them

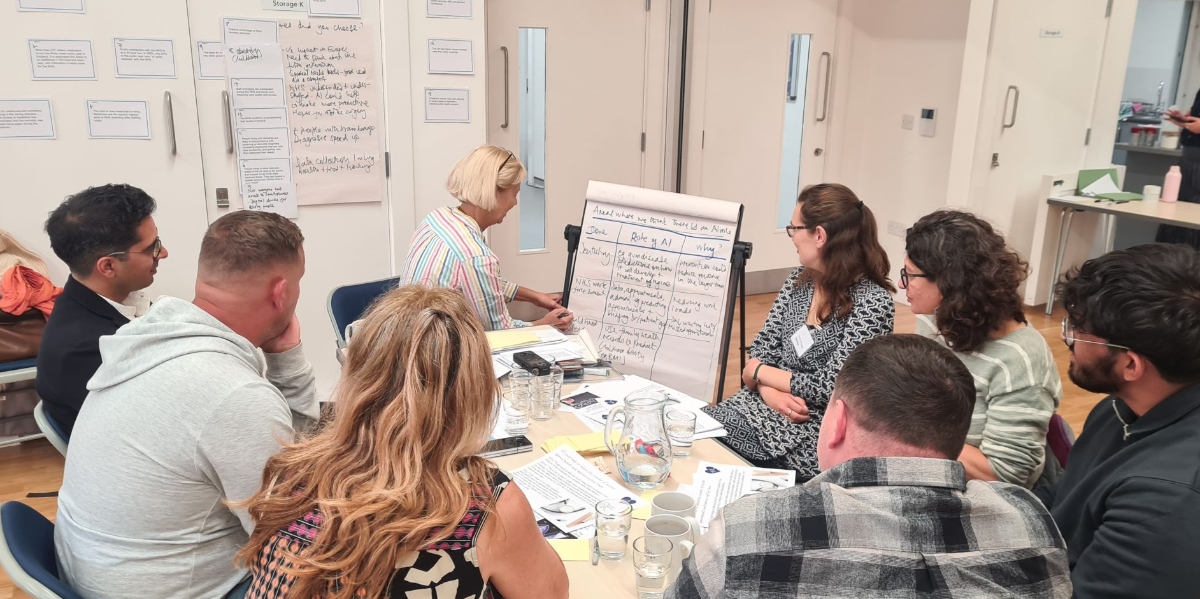

- See e.g. ai@cam public dialogues: https://ai.cam.ac.uk/projects/public-dialogues.html

Good Process Drives Purpose

Developing Digital Literacy at Board Level

The Future of Banking: Architecting Human-Machine Collaboration

.

Conclusion

- AI reshapes information flows - understand your information topography

- Balance centralized control and devolved decision-making

- Recognize LLMs as interfaces, not substitutes for human judgment

Strategic Priorities

- Build intelligent accountability into your AI deployments

- Focus on domain expertise leading AI implementation

- Invest in developing institutional character around AI use

- Maintain human judgment in critical decisions

- Prioritize customer trust and relationships

Thanks!

book: The Atomic Human

twitter: @lawrennd

The Atomic Human pages atomic human, the 13 , Le Scaphandre et le papillon (The Diving Bell and the Butterfly) 10–12, Bauby, Jean Dominique 9–11, 18, 90, 99-101, 133, 186, 212–218, 234, 240, 251–257, 318, 368–369, Shannon, Claude 10, 30, 61, 74, 98, 126, 134, 140, 143, 149, 260, 264, 269, 277, 315, 358, 363, Horizon scandal 371, MONIAC 232-233, 266, 343, human-analogue machine (HAMs) 343-347, 359-359, 365-368.

newspaper: Guardian Profile Page

blog posts:

Dan Andrews image of our reflective obsession with AI

Dan Andrews image from Chapter 3